A credit score is a numerical assessment of the creditworthiness of a person. This score is based on the information in the creditor’s files and how it matches your credit history. The simplest credit scoring system is the FICO score, created by Fair Isaac Corporation, now owned by TransUnion. FICO scores are calculated from the information in consumers’ credit reports, including their account balances and payment history. Here we will discuss how the credit scoring system work.

1. How The Credit Scoring System Works

Credit scoring systems work by calculating a single number representing an individual’s creditworthiness. This number is usually called a “credit score.” A credit score can range from 300 to 850, with higher numbers indicating better creditworthiness. While there are several different scoring systems, most of them incorporate information from one or more primary sources: the consumer’s credit report, public records such as bankruptcy filings, credit bureau updates on new accounts opened, and payments made on existing accounts. The information gathered from these sources is compiled into one or more scoring models and then assigned a numerical value based on the individual’s credit report information.

2. Credit Score Formula

Credit scores are calculated using a formula that considers three main factors: The amount of debt you owe, how long you’ve held those debts, and the type of credit you are using. The amount of debt you owe is the most critical factor in a credit score. This determines the size of your financial obligation to the lender and how much money you need from them. The length of time you have had your debts also affects your credit score. The longer you’ve had any debts, and the larger those debts are in relation to the amount owed, the higher your credit score. This formula has been developed to predict the likelihood that a person will repay their debts. It doesn’t take into account the person’s income or their ability to repay the debt. It only takes into account the amount of debt that they have and how long that debt has been outstanding.

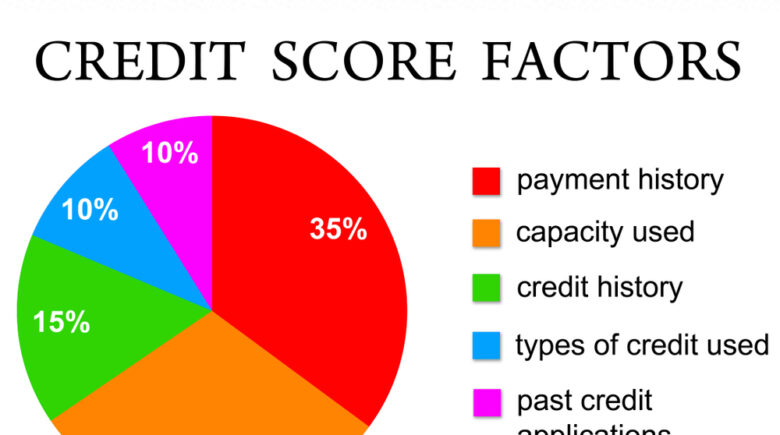

3. Components of Your Credit Score

The report will contain various information about your credit, such as the amount of debt you owe, how much debt you have, how much your creditors are owed, and the length of time you have had credit. The most critical information in your report is the amount of time you have had credit. This is called the “credit history.” It will also contain information on whether or not you are a reasonable risk for future borrowing. Because this score is based on your past actions, it will be affected by what happens in the future.

4. Factors That Can Affect Credit Scores

Many factors can affect a person’s credit score. These include the age of the individual; the age of their oldest account (if they have more than one) and how long it has been open for business; the amount of debt owed on each account; the length of time between accounts being opened; whether the account has been paid in full or only partially; how long it took for an account to be paid off completely; and whether there are any unpaid bills still owed on an account. Other factors that can affect a credit score include the number of credit cards or loans an individual is carrying. The more cards or loans a person has, the lower their credit score is likely to be. This shows they are in debt and may not be able to pay off the outstanding balances.

5. How Your Credit Score Is Affected By Your Credit History

The type of credit you have also plays a role in your credit score. The longer and more often you use different types of credit, the higher your score will be. For example, if you are trying to get a mortgage for the first time, your score will reflect your ability to manage debt. But if you already own a home and have established an excellent track record with lenders, your score will reflect that knowledge of how to manage debt. Credit bureaus also consider whether or not creditors have sued you in cases where there was not enough money owed on the account (for example, if a company has gone out of business). This question is called “judgment” or “dishonor” on your credit report.

6. How to Improve Your Credit Score

It is impossible to improve your credit score if you do not have one in the first place. You must start by getting a copy of your credit report from the consumer reporting agencies. It is essential that this report includes all of your accounts and information, even if it is negative. Once you have these reports, check each account to see if there are any errors in the information provided. If you have a low score, there are ways to improve it. Here are some tips: pay your bills on time; don’t open too many new accounts at once; keep old credit cards or lines of credit open instead of closing them; don’t close any accounts unless they have an outstanding balance; don’t apply for a lot of new credit all at once; and, if you do apply for new accounts, make sure they’re installment accounts (not revolving lines of credit).

Credit scoring is an ongoing process that can be used to help you understand your credit rating. Credit scoring systems are available across various industries, including finance, insurance, government, and retail. Banks and credit card companies use credit scoring to determine whether or not to give you a loan and at what interest rate, while insurance companies use it to decide whether or not to insure you. Credit scoring is also used by employers in the hiring process and by landlords when determining whether or not to rent you an apartment. Financial health is key to overall health, and credit scoring is a tool that can be used to indicate both your financial health and how well you manage your money.

A credit score is a numerical assessment of the creditworthiness of a person. This score is based on the information in the creditor’s files and how it matches your credit history. The simplest credit scoring system is the FICO score, created by Fair Isaac Corporation, now owned by TransUnion. FICO scores are calculated from the information in consumers’ credit reports, including their account balances and payment history. Here we will discuss how the credit scoring system work.

1. How The Credit Scoring System Works

Credit scoring systems work by calculating a single number representing an individual’s creditworthiness. This number is usually called a “credit score.” A credit score can range from 300 to 850, with higher numbers indicating better creditworthiness. While there are several different scoring systems, most of them incorporate information from one or more primary sources: the consumer’s credit report, public records such as bankruptcy filings, credit bureau updates on new accounts opened, and payments made on existing accounts. The information gathered from these sources is compiled into one or more scoring models and then assigned a numerical value based on the individual’s credit report information.

2. Credit Score Formula

Credit scores are calculated using a formula that considers three main factors: The amount of debt you owe, how long you’ve held those debts, and the type of credit you are using. The amount of debt you owe is the most critical factor in a credit score. This determines the size of your financial obligation to the lender and how much money you need from them. The length of time you have had your debts also affects your credit score. The longer you’ve had any debts, and the larger those debts are in relation to the amount owed, the higher your credit score. This formula has been developed to predict the likelihood that a person will repay their debts. It doesn’t take into account the person’s income or their ability to repay the debt. It only takes into account the amount of debt that they have and how long that debt has been outstanding.

3. Components of Your Credit Score

The report will contain various information about your credit, such as the amount of debt you owe, how much debt you have, how much your creditors are owed, and the length of time you have had credit. The most critical information in your report is the amount of time you have had credit. This is called the “credit history.” It will also contain information on whether or not you are a reasonable risk for future borrowing. Because this score is based on your past actions, it will be affected by what happens in the future.

4. Factors That Can Affect Credit Scores

Many factors can affect a person’s credit score. These include the age of the individual; the age of their oldest account (if they have more than one) and how long it has been open for business; the amount of debt owed on each account; the length of time between accounts being opened; whether the account has been paid in full or only partially; how long it took for an account to be paid off completely; and whether there are any unpaid bills still owed on an account. Other factors that can affect a credit score include the number of credit cards or loans an individual is carrying. The more cards or loans a person has, the lower their credit score is likely to be. This shows they are in debt and may not be able to pay off the outstanding balances.

5. How Your Credit Score Is Affected By Your Credit History

The type of credit you have also plays a role in your credit score. The longer and more often you use different types of credit, the higher your score will be. For example, if you are trying to get a mortgage for the first time, your score will reflect your ability to manage debt. But if you already own a home and have established an excellent track record with lenders, your score will reflect that knowledge of how to manage debt. Credit bureaus also consider whether or not creditors have sued you in cases where there was not enough money owed on the account (for example, if a company has gone out of business). This question is called “judgment” or “dishonor” on your credit report.

6. How to Improve Your Credit Score

It is impossible to improve your credit score if you do not have one in the first place. You must start by getting a copy of your credit report from the consumer reporting agencies. It is essential that this report includes all of your accounts and information, even if it is negative. Once you have these reports, check each account to see if there are any errors in the information provided. If you have a low score, there are ways to improve it. Here are some tips: pay your bills on time; don’t open too many new accounts at once; keep old credit cards or lines of credit open instead of closing them; don’t close any accounts unless they have an outstanding balance; don’t apply for a lot of new credit all at once; and, if you do apply for new accounts, make sure they’re installment accounts (not revolving lines of credit).

Credit scoring is an ongoing process that can be used to help you understand your credit rating. Credit scoring systems are available across various industries, including finance, insurance, government, and retail. Banks and credit card companies use credit scoring to determine whether or not to give you a loan and at what interest rate, while insurance companies use it to decide whether or not to insure you. Credit scoring is also used by employers in the hiring process and by landlords when determining whether or not to rent you an apartment. Financial health is key to overall health, and credit scoring is a tool that can be used to indicate both your financial health and how well you manage your money.